Efficient property management requires more than just collecting rent and paying bills. It demands a comprehensive understanding of financial performance, compliance, and strategic planning. Here are the key property management accounting reports that matter most:

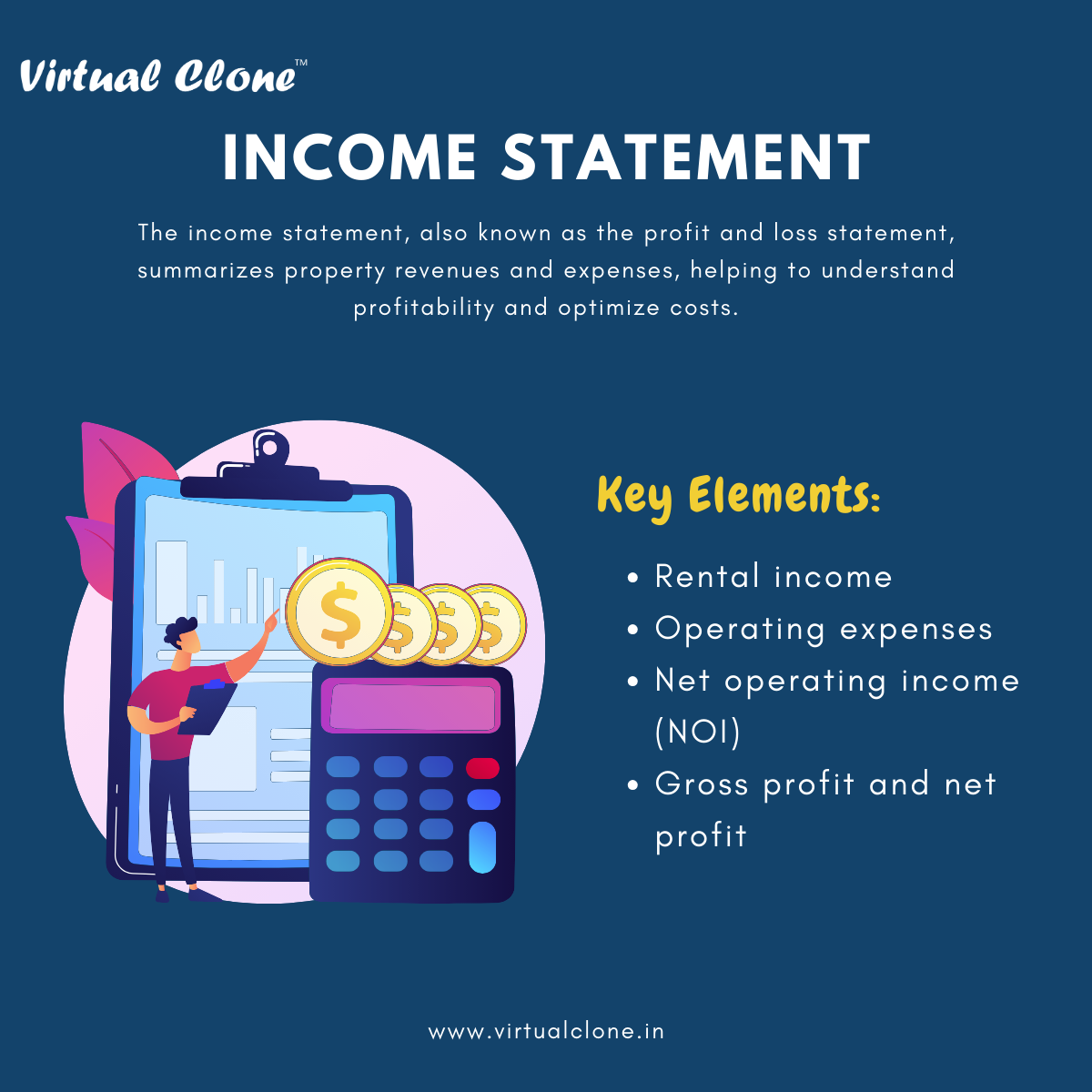

1. Income Statement

The income statement, also known as the profit and loss statement, summarizes the property’s revenues and expenses over a specific period. This report helps property managers and owners understand the property’s profitability and identify areas to optimize costs.

The income statement, also known as the profit and loss statement, summarizes property revenues and expenses, helping to understand profitability and optimize costs.

Key Elements:

- Rental income

- Operating expenses

- Net operating income (NOI)

- Gross profit and net profit

2. Balance Sheet

The balance sheet provides a snapshot of the property’s financial position at a given point in time. It includes assets, liabilities, and equity, offering insights into the property’s financial stability and liquidity.

Key Elements:

- Current and long-term assets

- Current and long-term liabilities

- Owner’s equity

3. Cash Flow Statement

The cash flow statement tracks the flow of cash in and out of the property, highlighting the sources and uses of cash. This report is crucial for understanding the property’s liquidity and ensuring there is enough cash to cover expenses.

Key Elements:

- Operating cash flow

- Investing cash flow

- Financing cash flow

- Net cash flow

4. Rent Roll Report

The rent roll report provides a detailed overview of the rental income generated by each unit or tenant. It includes lease terms, rent amounts, and occupancy status, helping managers track rental performance and identify vacancies or late payments.

Key Elements:

- Tenant names

- Lease start and end dates

- Monthly rent amount

- Occupancy status

5. Budget vs. Actual Report

This report compares the property’s actual financial performance against the budgeted figures. It helps property managers identify variances, understand the reasons behind them, and adjust financial planning accordingly.

Key Elements:

- Budgeted income and expenses

- Actual income and expenses

- Variance analysis

6. Accounts Receivable Aging Report

The accounts receivable aging report shows the status of outstanding rent payments, categorized by the length of time they have been overdue. This report is essential for managing collections and reducing bad debt.

Key Elements:

- Tenant names

- Amounts owed

- Aging categories (e.g., 30 days, 60 days, 90+ days overdue)

7. Maintenance and Repair Report

This report tracks the costs and status of maintenance and repair activities, helping property managers manage expenses and ensure the property remains in good condition.

Key Elements:

- Maintenance requests

- Completed and pending repairs

- Associated costs

Conclusion

Property management accounting reports provide vital insights into the financial health and operational efficiency of a property. By regularly reviewing these reports, property managers can make informed decisions, optimize financial performance, and ensure the long-term success of their properties.