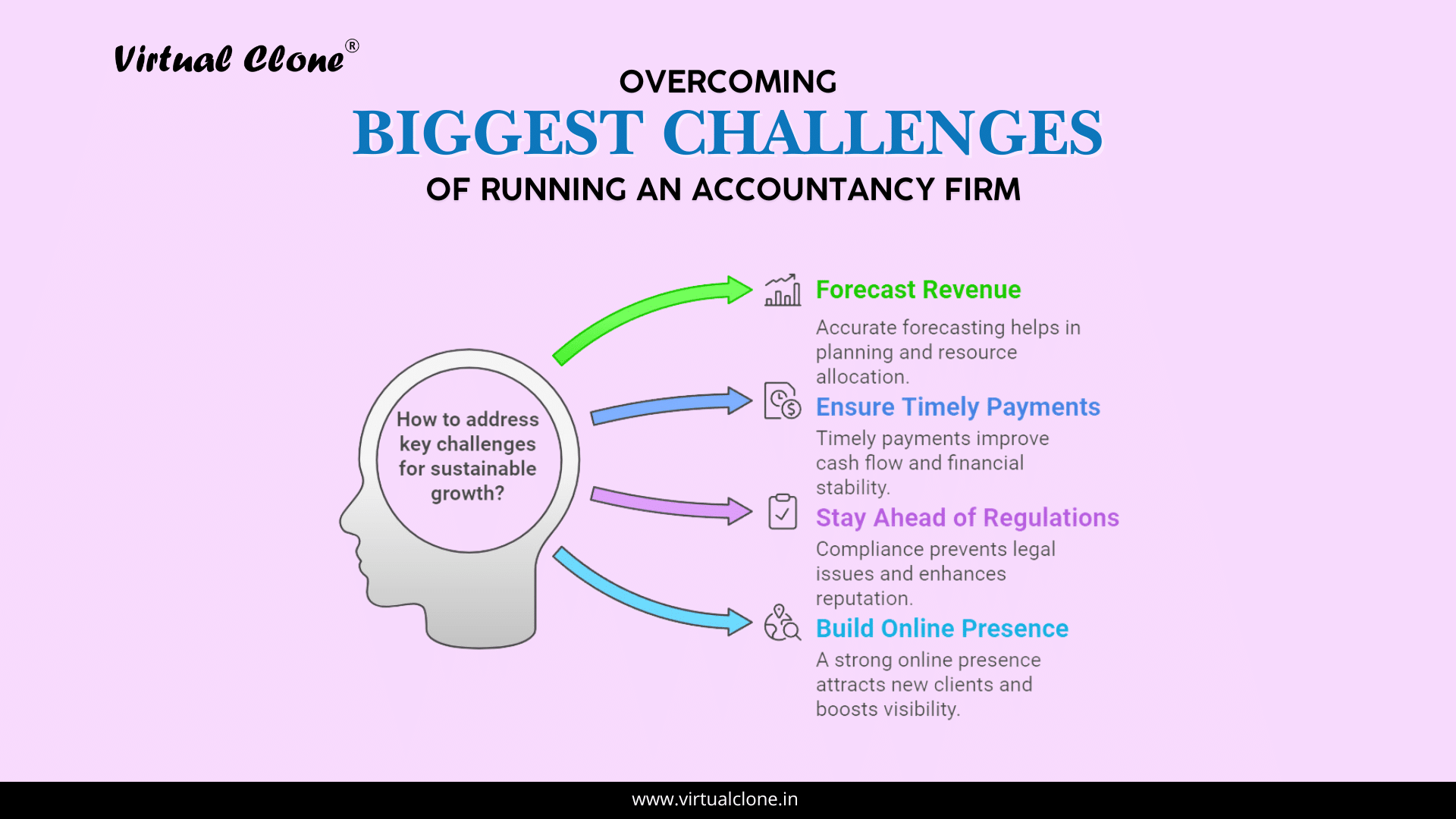

Running an accountancy firm offers great rewards, but it comes with its own set of hurdles that demand strategic planning and efficient solutions. The challenges of accountancy firms range from accurate revenue forecasting and timely client payments to keeping up with regulatory changes and strengthening their digital presence. By addressing these obstacles with smart strategies and the right tools, you can overcome these issues and set your firm on the path to sustainable growth.

1. Revenue Forecasting

Challenge:

Predicting revenue is critical for growth, but market shifts and changing client demands make it tough.

Solution:

- Analyze the market: Stay updated on industry trends to make informed forecasts.

- Use conservative estimates: Plan for best and worst-case scenarios to avoid surprises.

- Refine projections: Regularly adjust forecasts based on actual data.

- Leverage forecasting apps: Tools like Syft and ProjectWorks provide detailed and accurate revenue visualizations, helping you plan better.

2. Timesheeting and Tracking Hours

Challenge:

Keeping track of hours worked is essential for billing and resource management, but manual tracking is time-consuming and error-prone.

Solution:

- Automate time tracking: Use tools like MinuteDock for real-time tracking.

- Integrate with accounting software: Pair MinuteDock with platforms like Xero to streamline invoicing and reduce errors.

3. Project Management and Resourcing

Challenge:

Managing multiple projects with limited resources can lead to missed deadlines and overworked teams.

Solution:

- Prioritize projects: Allocate resources based on deadlines and importance.

- Use project management tools: Platforms like Trello or Asana help organize tasks and monitor progress.

- Communicate effectively: Regular team check-ins ensure alignment and prevent bottlenecks.

4. Getting Paid on Time

Challenge:

Late payments disrupt cash flow, affecting operations and adding unnecessary stress.

Solution:

- Set clear payment terms: Outline payment deadlines in contracts and invoices.

- Send reminders: Use automated invoice reminders to follow up with clients.

- Automate collections: Tools like GoCardless or Xero’s online payment options simplify payment collection, ensuring a steady cash flow.

5. Client Retention and Acquisition

Challenge:

Keeping existing clients happy while attracting new ones can be a delicate balancing act.

Solution:

- Prioritize client satisfaction: Offer proactive advice, timely communication, and quality services.

- Leverage technology: Use CRM tools like HubSpot or Zoho CRM to manage client interactions and personalize services.

- Invest in marketing: Share success stories, offer free resources (like tax tips), and maintain an active online presence to attract potential clients.

6. Keeping Up with Regulatory Changes

Challenge:

Tax laws, compliance requirements, and accounting standards are constantly evolving.

Solution:

- Stay informed: Subscribe to industry newsletters and attend seminars/webinars.

- Train your team: Conduct regular training to ensure everyone understands new regulations.

- Automate compliance tasks: Tools like TaxFyle or Avalara help stay compliant effortlessly.

7. Technology and Cybersecurity

Challenge:

Relying on outdated systems can lead to inefficiencies, and weak security measures put sensitive client data at risk.

Solution:

- Upgrade your tools: Use cloud-based solutions like QuickBooks Online or Xero for flexibility and efficiency.

- Strengthen cybersecurity: Implement strong passwords, two-factor authentication, and regular security audits to protect client data.

8. Employee Engagement and Retention

Challenge:

High-pressure work environments can lead to employee burnout and turnover.

Solution:

- Promote work-life balance: Offer flexible working hours or remote work options.

- Encourage growth: Provide opportunities for skill development through training and certifications.

- Foster a positive culture: Recognize employee achievements and maintain open communication.

9. Data Analytics for Decision-Making

Challenge:

Many accountancy firms collect a lot of data but fail to leverage it for insights.

Solution:

- Use analytics tools: Platforms like Fathom or Spotlight Reporting help transform raw data into actionable insights.

- Monitor key metrics: Track KPIs such as client profitability, resource utilization, and cash flow trends.

- Regular reviews: Hold monthly strategy meetings to analyze reports and refine your approach.

10. Scaling the Business

Challenge:

As your firm grows, managing more clients, staff, and operations can strain resources and systems.

Solution:

- Standardize processes: Create SOPs for tasks like onboarding, reporting, and client communication.

- Outsource non-core tasks: Delegate functions like payroll or admin support to outsourcing partners like Virtual Clone.

- Invest in scalable technology: Use robust software that can handle your growing needs without significant disruptions.

11. Building a Strong Online Presence

Challenge:

Many potential clients research firms online before reaching out, so a weak online presence can limit growth opportunities.

Solution:

- Optimize your website: Ensure it’s professional, easy to navigate, and SEO-friendly.

- Engage on social media: Share valuable content, interact with followers, and showcase your expertise.

- Encourage reviews: Ask satisfied clients to leave positive reviews on platforms like Google and LinkedIn.

12. Managing Cash Flow Effectively

Challenge:

Poor cash flow management can lead to operational disruptions and missed opportunities.

Solution:

- Forecast cash flow: Use tools like Float or CashFlowTool to predict and manage your cash flow.

- Maintain a buffer: Keep emergency funds for unforeseen circumstances.

- Streamline billing cycles: Reduce the time between project completion and payment collection.

13. Differentiating Your Firm in a Competitive Market

Challenge:

Standing out in a crowded market can be tough, especially when competitors offer similar services.

Solution:

- Define your niche: Specialize in serving specific industries (e.g., healthcare, tech startups).

- Offer value-added services: Provide advisory services, tax planning, or financial insights beyond basic accounting.

- Showcase your expertise: Publish case studies, blogs, or white papers to highlight your success stories.

The challenges of running an accountancy firm are real, but they are also opportunities to improve and innovate. By addressing these pain points with the right strategies and tools, your firm can thrive in an ever-changing market.

Virtual Clone is here to assist at every step, from automating processes to supporting your firm with tailored solutions. Let us be your partner in growth.

Contact us today and discover how we can help your firm overcome its challenges and achieve success.