In today’s dynamic business environment, effective financial management is crucial for success. Management reporting tools play a vital role in providing accurate and actionable insights, enabling businesses to make informed decisions. This blog post explores some of the top management reporting tools in accounting and finance, highlighting their key features, advantages, and disadvantages to help you choose the right tool for your needs.

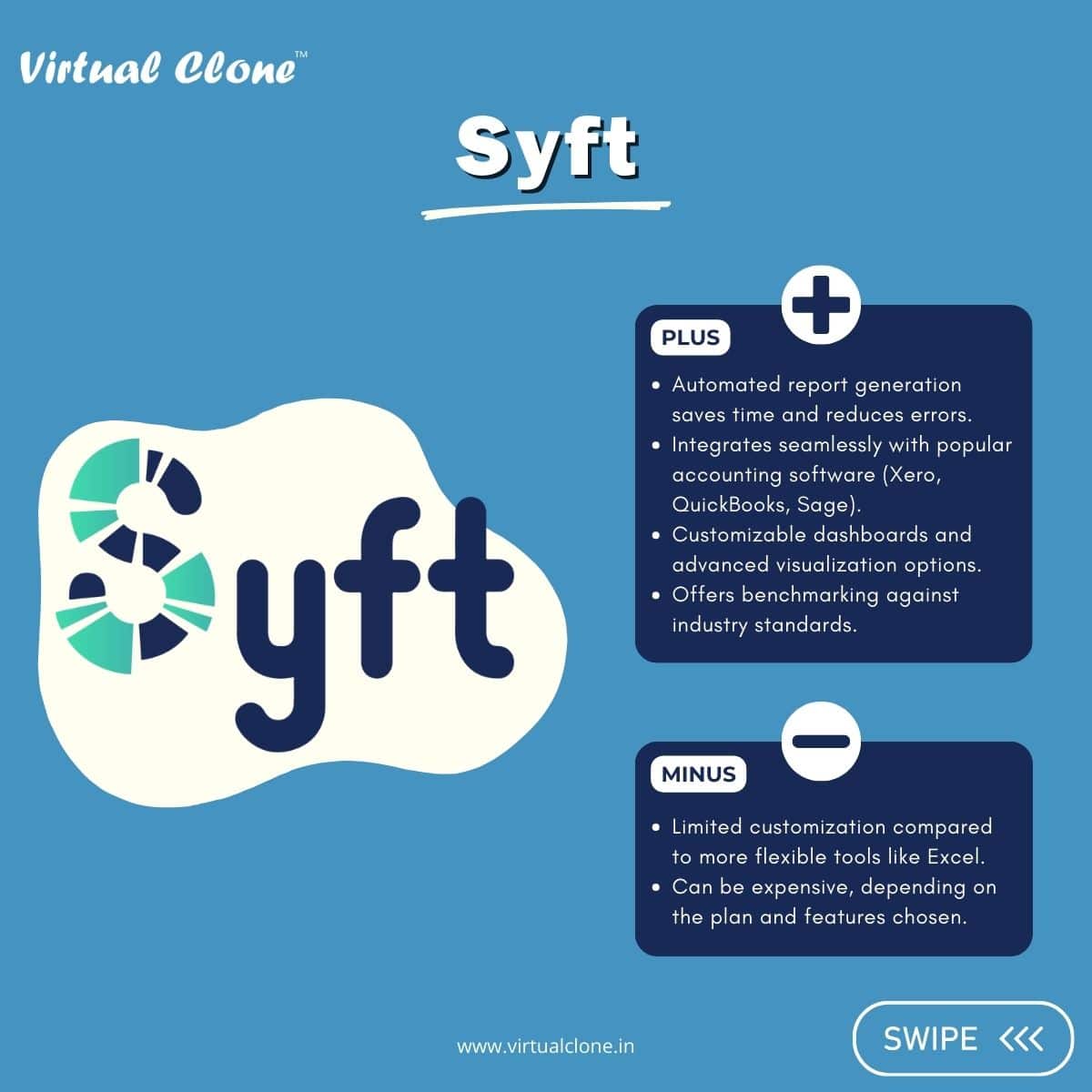

1. Syft

Syft is a cloud-based financial analysis and reporting tool designed for accountants, financial professionals, and business owners.

Key Features:

- Automated Reports: Generates automated management reports, including financial statements, cash flow forecasts, and KPI dashboards.

- Data Integration: Seamlessly integrates with popular accounting software like Xero, QuickBooks, and Sage.

- Customizable Dashboards: Users can create customized dashboards to track key metrics and financial performance indicators.

- Visualization: Offers advanced visualization tools, including graphs and charts, to present data clearly and effectively.

- Benchmarking: Allows for benchmarking against industry standards or other companies within the same sector.

Advantages:

- Saves time with automated report generation.

- Provides detailed insights through customizable dashboards.

- Facilitates benchmarking for performance comparison.

Disadvantages:

- Limited customization compared to more flexible tools like Excel.

- Can be expensive, depending on the plan and features chosen.

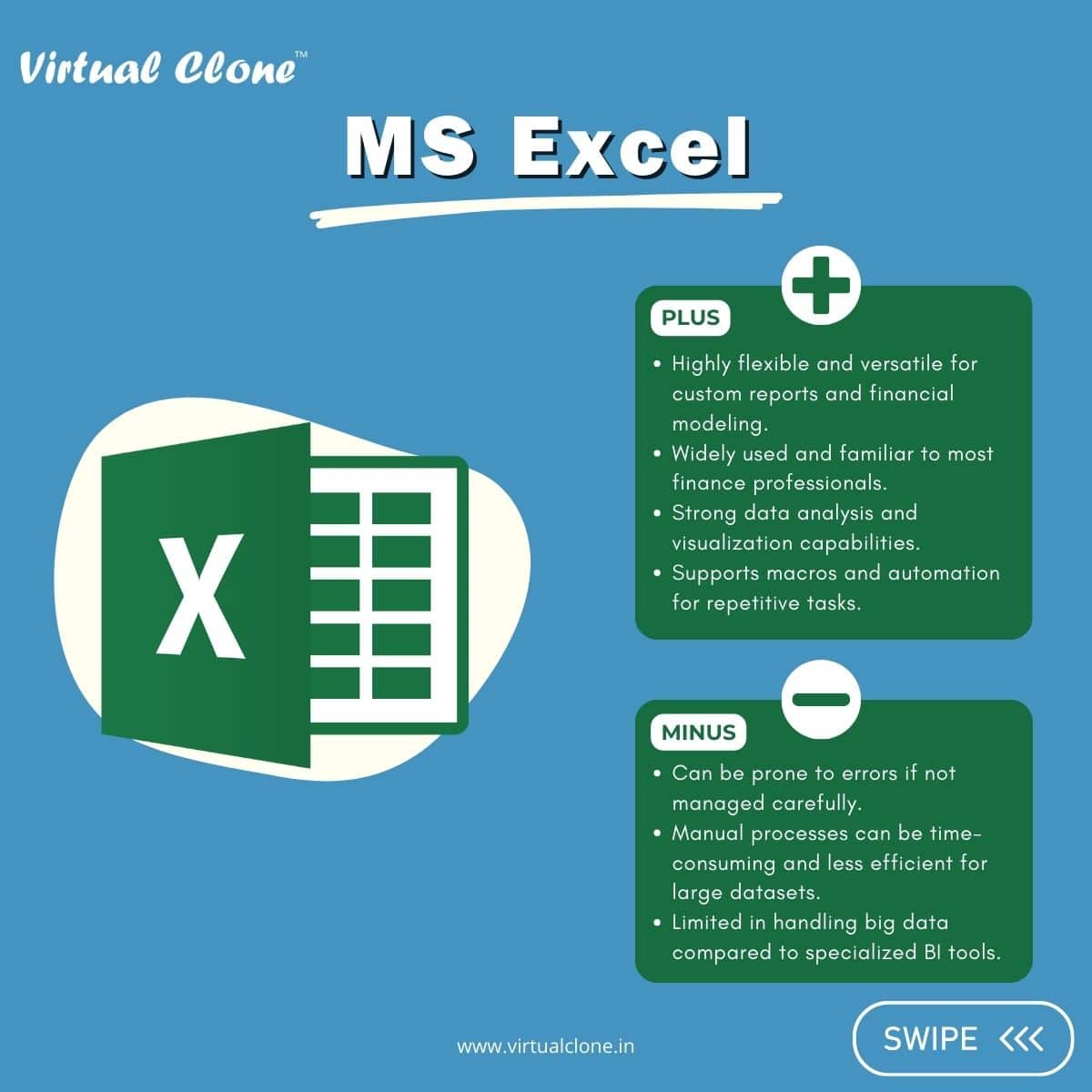

2. Microsoft Excel

Excel is one of the most widely used tools for financial reporting and analysis due to its flexibility and powerful features.

Key Features:

- Data Analysis: Provides various functions and formulas for data analysis, such as pivot tables, VLOOKUP, and SUMIFS.

- Custom Reports: Users can create customized reports and financial models tailored to specific business needs.

- Visualization Tools: Offers charting and graphing capabilities to visualize data trends and insights.

- Data Integration: Can import data from various sources, including databases, other spreadsheets, and ERP systems.

- Macros and Automation: Users can write macros to automate repetitive tasks, such as data entry and report generation.

Advantages:

- Highly flexible and versatile for custom reports and financial modeling.

- Widely used and familiar to most finance professionals.

- Strong data analysis and visualization capabilities.

Disadvantages:

- Can be prone to errors if not managed carefully.

- Manual processes can be time-consuming and less efficient for large datasets.

- Limited in handling big data compared to specialized BI tools.

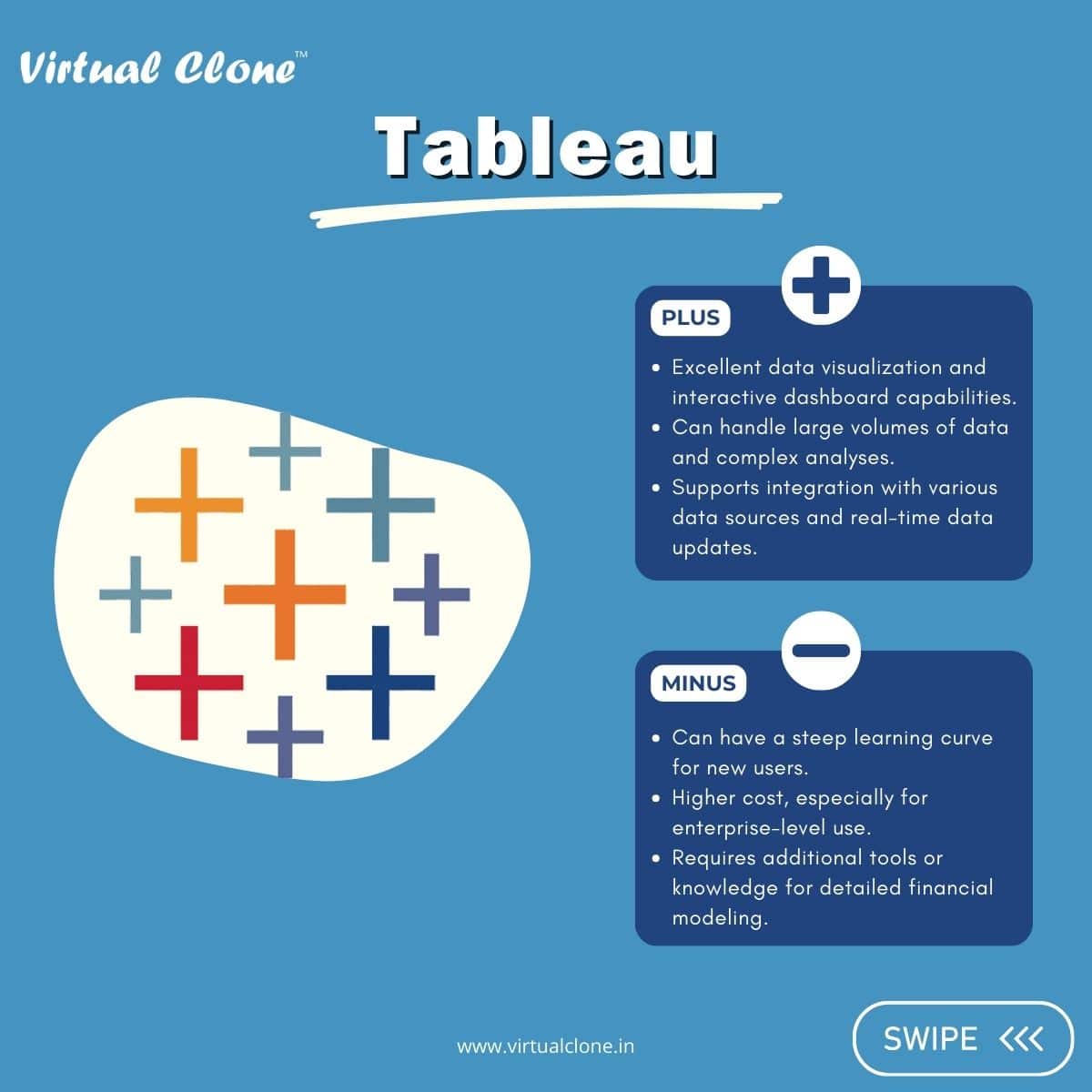

3. Tableau

Tableau is known for its advanced data visualization capabilities and is widely used for creating interactive dashboards and reports.

Key Features:

- Data Visualization: Offers powerful tools for creating interactive dashboards, charts, and graphs.

- Large Data Handling: Can handle large volumes of data and perform complex analyses.

- Integration: Supports integration with various data sources and real-time data updates.

- User-Friendly: Intuitive drag-and-drop interface for ease of use.

Advantages:

- Excellent data visualization and interactive dashboard capabilities.

- Can handle large volumes of data and complex analyses.

- Supports integration with various data sources.

Disadvantages:

- Can have a steep learning curve for new users.

- Higher cost, especially for enterprise-level use.

- Requires additional tools or knowledge for detailed financial modeling.

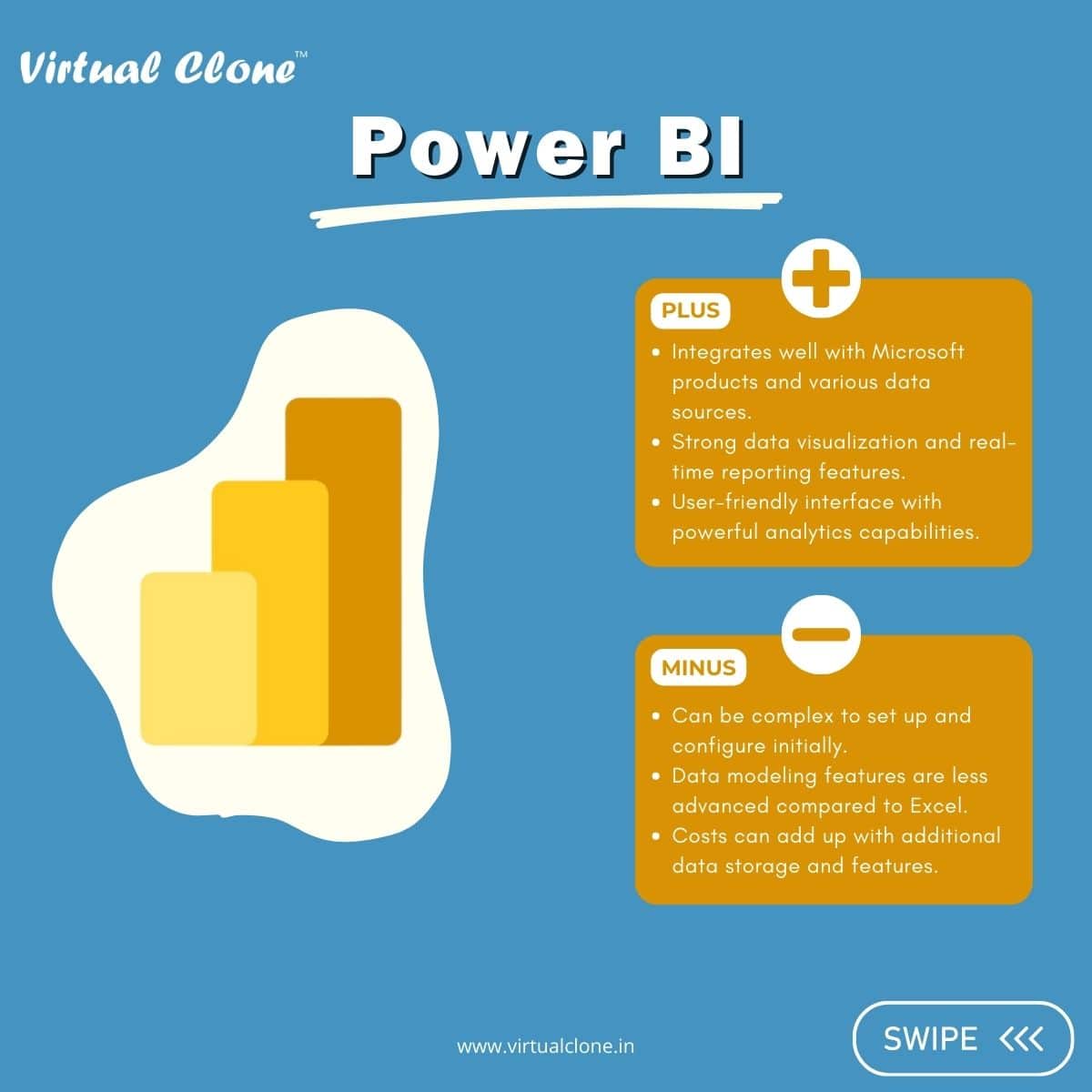

4. Power BI

Power BI, a Microsoft product, is known for its robust data visualization and business intelligence capabilities.

Key Features:

- Integration: Integrates well with Microsoft products and various data sources.

- Visualization: Strong data visualization and real-time reporting features.

- User-Friendly: User-friendly interface with powerful analytics capabilities.

- Custom Reports: Ability to create detailed and custom reports.

Advantages:

- Integrates well with Microsoft products and various data sources.

- Strong data visualization and real-time reporting features.

- User-friendly interface with powerful analytics capabilities.

Disadvantages:

- Can be complex to set up and configure initially.

- Data modeling features are less advanced compared to Excel.

- Costs can add up with additional data storage and features.

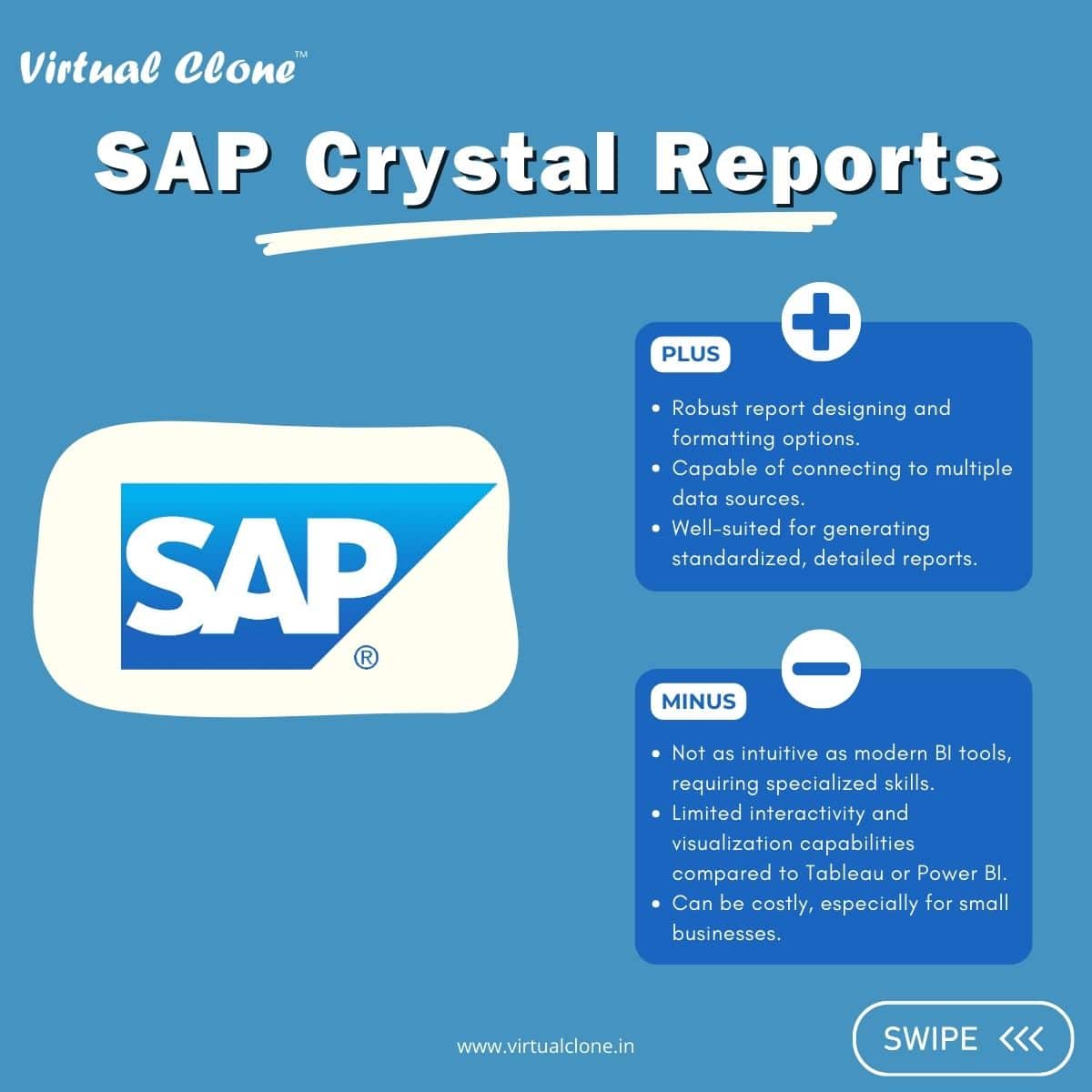

5. SAP Crystal Reports

SAP Crystal Reports is a robust tool for designing and generating detailed reports from various data sources.

Key Features:

- Report Designing: Robust report designing and formatting options.

- Data Integration: Capable of connecting to multiple data sources.

- Detailed Reports: Well-suited for generating standardized, detailed reports.

Advantages:

- Robust report designing and formatting options.

- Capable of connecting to multiple data sources.

- Well-suited for generating standardized, detailed reports.

Disadvantages:

- Not as intuitive as modern BI tools, requiring specialized skills.

- Limited interactivity and visualization capabilities compared to Tableau or Power BI.

- Can be costly, especially for small businesses.

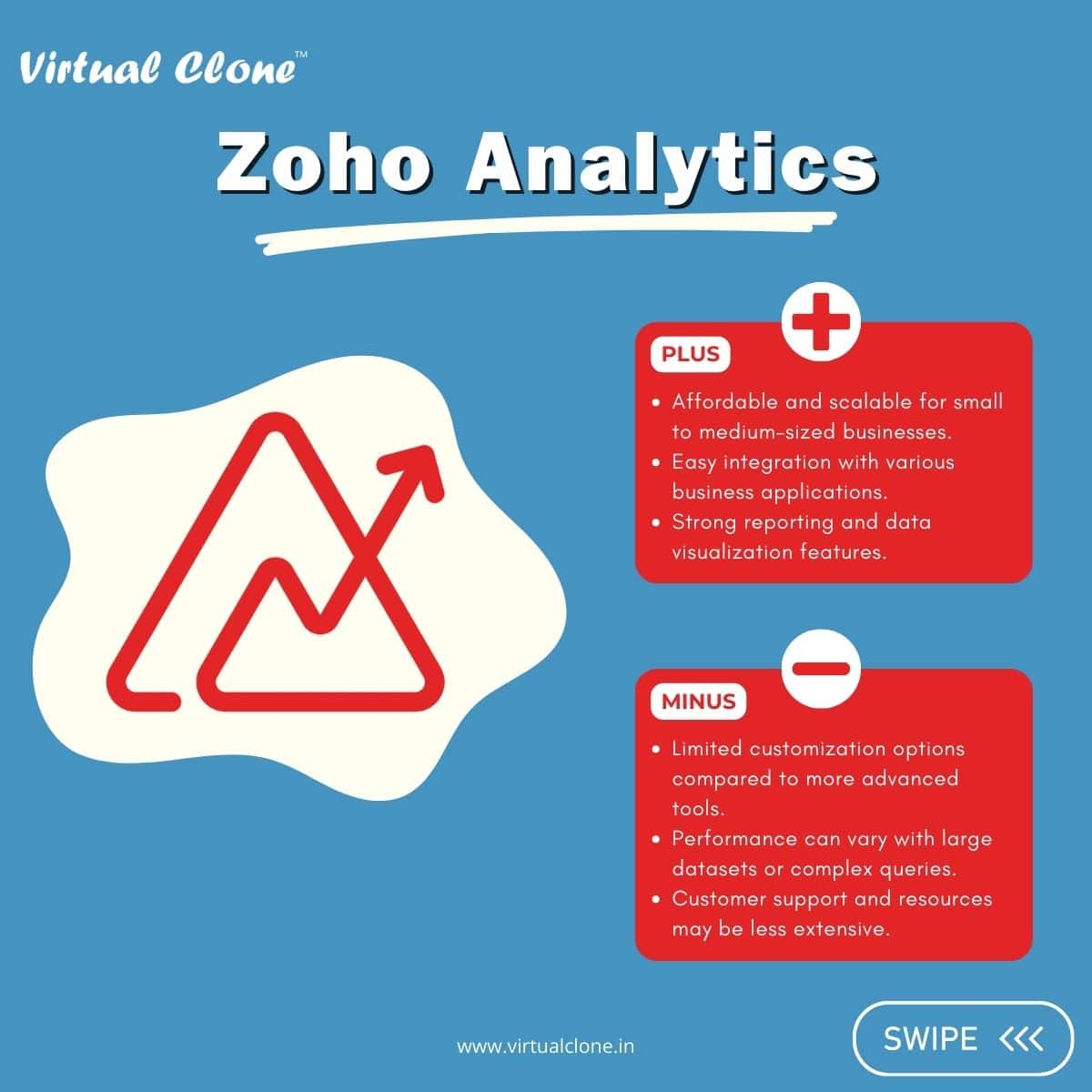

6. Zoho Analytics

Zoho Analytics is an affordable and scalable online reporting and business intelligence tool.

Key Features:

- Affordability: Affordable and scalable for small to medium-sized businesses.

- Integration: Easy integration with various business applications.

- Visualization: Strong reporting and data visualization features.

- Custom Reports: Ability to create custom reports and dashboards.

Advantages:

- Affordable and scalable for small to medium-sized businesses.

- Easy integration with various business applications.

- Strong reporting and data visualization features.

Disadvantages:

- Limited customization options compared to more advanced tools.

- Performance can vary with large datasets or complex queries.

- Customer support and resources may be less extensive.

7. Silverfin

Silverfin specializes in real-time data consolidation and reporting for accountants, offering advanced automation features.

Key Features:

- Data Consolidation: Real-time data consolidation and reporting.

- Integration: Integrates with various accounting systems and data sources.

- Automation: Strong automation features for compliance and reporting tasks.

- Insights and Analytics: Offers insights and analytics to improve client advisory services.

Advantages:

- Specializes in real-time data consolidation and reporting for accountants.

- Integrates with various accounting systems and data sources.

- Strong automation features for compliance and reporting tasks.

Disadvantages:

- Primarily geared towards accounting firms, which may limit its utility for other types of businesses.

- Higher cost for full-featured plans and services.

- Learning curve for users unfamiliar with specialized accounting software.

Conclusion

Choosing the right management reporting tool depends on your business size, complexity of transactions, and specific needs. Here’s a quick summary to help you decide:

- Syft: Ideal for businesses needing automated, standardized reports and benchmarking capabilities.

- Microsoft Excel: Perfect for those who need highly customizable reports and financial models.

- Tableau: Best for businesses requiring advanced data visualization and interactive dashboards.

- Power BI: Suitable for those looking for robust integration with Microsoft products and real-time reporting.

- SAP Crystal Reports: Great for generating standardized, detailed reports from multiple data sources.

- Zoho Analytics: Affordable option for small to medium-sized businesses with strong reporting features.

- Silverfin: Specialized for accounting firms needing real-time data consolidation and advanced automation.

Each tool offers unique benefits and challenges, making it important to choose the one management reporting tool that best fits your business needs and budget.